What Is a 1031 Exchange? Know the Rules

Real estate offers plenty of tax breaks to make investment more affordable. One of these tax breaks — Section 1031 — is perfect for investors looking to capitalize on property appreciation and acquire new properties. When used correctly, Section 1031 could potentially let you defer all gains you make when selling your property. However, you must follow all the rules, and there are many. This article will explain Section 1031 and its requirements. Then, we’ll dive into the tax implications of various Section 1031 scenarios and cover some special rules.

What is Section 1031?

Section 1031 of the Internal Revenue Code (IRC) lets businesses and investment property owners delay federal capital gains taxes on property sales. An exchange under this section is called a 1031 exchange, a like-kind exchange, and sometimes, a Starker Exchange. To use Section 1031, the seller must invest their proceeds into a qualifying property within a specific timeframe. By paying less in taxes through a 1031 exchange, you have more capital to invest in the next property. As a result, Section 1031 can help you grow your portfolio faster. We’ll explore the intricacies and rules more below.

What Are the Rules of a 1031 Exchange?

Broadly speaking, a property owner can invest their property sale proceeds into another qualifying property to defer the capital gains taxes they would otherwise pay. That said, there are numerous rules to be aware of. Let’s examine these in more detail:

Investor Criteria For 1031 Exchange

Owners of investment and business properties may qualify for a Section 1031, whether they’re an individual, C corporation, S corporation, partnership, LLC, or trust.

Property Criteria For 1031 Exchange

The property you sell and the property you buy with the proceeds must each meet certain criteria. Firstly, both properties must be held for investment or use in trade or business. There are no hard and fast time requirements for holding the property. However, the longer, the better. The IRS may not consider your property held for investment purposes if you sell immediately after buying. Also, personal-use properties, like primary residences and vacation homes, generally don't qualify. You can get around this if you follow rules discussed later. If both properties meet the investment/use requirement, you must determine if they're similar enough for like-kind classification. Fortunately, the IRS is broad in what properties count as like-kind. According to the IRS website: “Properties are of like-kind if they’re of the same nature or character, even if they differ in grade or quality. Real properties generally are of like-kind, regardless of whether they’re improved or unimproved. For example, an apartment building would generally be like-kind to another apartment building.” That means you can exchange undeveloped land for an improved property, like a multifamily apartment building. However, property outside of the US is not considered like-kind to property in the US. Speaking of exceptions, the following property types do not qualify for Section 1031 treatment:

- Inventory or stock in trade

- Stocks, bonds, or notes

- Other securities or debt

- Partnership interests

- Certificates of trust

- Personal property — No longer allowed after Tax Cuts and Jobs Act of 2017 (TCJA)

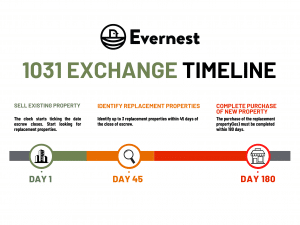

Timing: 45-Day and 180-Day Rules

Investors must identify the new property within 45 days of sale and acquire it within 180 days of sale. These periods run simultaneously. If you identify the new property on day 45, you only have 135 to acquire it. These same periods apply backward with a “reverse exchange” if you buy the new property before selling the old one. To qualify, you first transfer the new property to an exchange accommodation titleholder. Then, you must sell the old property within 180 days of buying the new one.

Investors must identify the new property within 45 days of sale and acquire it within 180 days of sale. These periods run simultaneously. If you identify the new property on day 45, you only have 135 to acquire it. These same periods apply backward with a “reverse exchange” if you buy the new property before selling the old one. To qualify, you first transfer the new property to an exchange accommodation titleholder. Then, you must sell the old property within 180 days of buying the new one.

Special Rules For Depreciable Property: 1031 Depreciation Capture

Investors can depreciate property for wear and tear and deduct it on their taxes. However, exchanging a property you depreciated may trigger a depreciation recapture. The IRS taxes this as ordinary income since depreciation reduces ordinary income.

1031 Exchange and How It Can Help Estate Planning

Heirs receive a “step-up” in the property’s cost basis. That means their cost basis becomes the property’s fair market value on the date the investor passes away. This could potentially exempt some or all of your gains from your heir’s taxes when they sell. Imagine you buy a $150,000 property and name your child as an heir in your estate plan. The property appreciates to a fair market value of $200,000 by the time you pass away. Your heir’s cost basis “steps up” to $200,000, which means those $50,000 of gains are potentially tax-free.

1031 Exchange Tax Implications: The “Boot” and Reporting

Section 1031 transactions can have complex tax consequences. Working with a tax professional (preferably with real estate expertise) is a good idea. That said, here are some 1031 tax basics to know of:

The 1031 Exchange “Boot”

The “boot” is cash or property the investor gives or receives alongside the like-kind exchange to complete the transaction. This “boot” can trigger taxable gains or losses — separate from the 1031 exchange — in the year the exchange occurs. The real property that is exchanged under 1031 still qualifies. In many cases, the boot results from buying a property worth less than the property sold. For example, if you sold one property for $200,000 and bought a $150,000 property, you still have $50,000 in cash. This may be considered a boot. Another way investors end up with a boot is by failing to pay attention to mortgage amounts. If your liability on the new property is lower than on the sold property, you may have a boot that is treated as income. Generally, investors can avoid boot-related taxes by buying an equally or more valuable property.

Tax Reporting

You must report 1031 exchanges in the year they occur, even if you defer all taxes or recognize no losses. Properly reporting 1031 exchanges can involve several tax forms. You report the exchange itself on Form 8824, Like-Kind Exchanges. This form contains the details you need to do it correctly. Gains from boots are reported on Form 8949, Schedule D (Form 1040), or Form 4797, depending on your situation. Depreciation recapture is reported on one of these forms if applicable.

Moving Into a 1031 Swap Residence

You can use your 1031 exchange replacement property as your new primary or second home. However, you must follow the IRS’s “safe harbor” rule to avoid losing the Section 1031 advantage. Here are the criteria for safe harbor qualification:

- Rent the property to another person for a fair rental for 14 or more days

- Your personal use of the property unit cannot exceed the greater of 14 days or 10% of the number of days during the 12-month period the dwelling unit is rented at a fair rental rate

Furthermore, you can’t take advantage of Section 121 for primary residences right away. You must make the property your primary residence for at least two of the past five years.

1031 Exchange Example

Imagine you own a property that appreciated to $320,000 over several years. Your remaining mortgage balance is $80,000. Your broker alerts you to an excellent property worth $400,000. They believe the property’s rents and value have room to grow. Therefore, you want to exit your current property and purchase this one. You sell your current property for $320,000 and pay off the remaining $80,000 mortgage, leaving you with $240,000. By putting all $240,000 toward the new property, you can potentially defer any gains made selling the old property. This provides you with more money for the new property. There is no boot if you put the entire amount towards the property because:

- You won’t keep any cash for yourself

- The mortgage needed to make up the gap is $160,000 — greater than your old mortgage

If the new property was worth less, resulting in a smaller mortgage or extra cash beyond the purchase price, you may have taxable boot gains.

Final Thoughts on 1031 Exchanges

Section 1031 is one of the best tax breaks a real estate investor can use — especially when trying to grow a portfolio more quickly. By letting you defer capital gains on property sales, you have more capital available to acquire new properties. However, there are numerous rules and requirements to be aware of. Breaking any of these could cause your transaction to lose Section 1031 status and experience tax consequences. It’s always good to consult a tax professional experienced in real estate. If you want to take advantage of Section 1031 to move into a new real estate opportunity, Evernest can help. We’ll work with you to find suitable opportunities for 1031 exchange and assist with selling and buying. Check out our markets to get started.